Convenience, affordability fueling frozen food popularity

A recent survey from the American Frozen Food Institute (AFFI) reveals that 68% of Americans purchase frozen food products at least weekly, if not more frequently.

Growth within the sector has been pushed by market disruptions such as the COVID-19 pandemic, inflation and the war in Ukraine.

The sector continues to grow as consumers seek out convenient and affordable frozen products with elevated shelf life. While performance is strong, there’s still room for growth. Better understanding consumer perceptions, usage and expectations could help processors continue to capitalize on this growing sector.

The frozen consumer

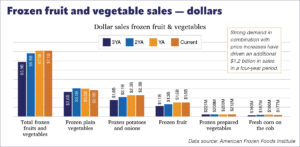

There’s good news for frozen fruit and vegetable suppliers: While frozen fruit and vegetable sales by volume are not as high as they were in the previous two years, they are still 271 million pounds ahead of pre-pandemic numbers, according to AFFI statistics. Strong demand and increased food prices have driven an additional $1.2 billion in sales in a four-year period.

In an attempt to better understand the perceptions and applications of frozen fruit and vegetables at home, AFFI commissioned the study to look at shopper demographics, motivations and uses.

“Frozen fruits and vegetables represent a healthy $7 billion of the entire frozen category in the United States,” said Mary Emma Young, vice president of communications at AFFI. “This study was an opportunity for the industry to better examine the positive attributes of this segment, assess current consumer use and anticipate the upcoming market trends and barriers.”

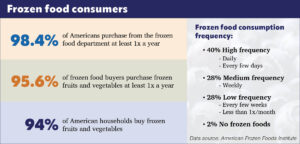

Some 1,525 U.S. consumers participated in the AFFI online survey, conducted in June 2022. Participants came from a range of economic backgrounds and represented ages 18-75. Of those who participated, 98.4% said they purchase from the frozen food department at least once a year. Of those, 40% are high frequency consumers, meaning they purchase frozen food daily or every few days. An additional 28% make purchases at least weekly.

According to AFFI’s survey, America’s core frozen fruit and vegetable consumers are more likely older millennials, located in the Northeast, from larger households with high income. They’re also likely to have children in the household, especially between the ages of 7 and 12.

Florida, California and Texas rank as the top three-selling states, while Oklahoma, Wyoming and Arizona rank as the top three-growth states.

Why frozen?

According to the study, 69% of core consumers plan meals with frozen fruits and vegetables in mind, while 89% said they like to have frozen produce available as a backup solution.

One of the major drivers behind purchasing frozen produce is convenience. Of those surveyed, 86% liked that buying frozen allowed them to stock up on a mix of different fruits and vegetables at once. Another 76% said frozen fruits and vegetables offered an easy alternative to fresh products that they either do not want to make or do not know how to.

Conagra, one of North America’s leading branded food companies and owner of the Birds Eye brand, understands the need to deliver products with convenience in mind.

Conagra, one of North America’s leading branded food companies and owner of the Birds Eye brand, understands the need to deliver products with convenience in mind.

“Consumers are motivated by convenience, flavor and health, which tie back to a struggle they are trying to solve,” said Natalie Nagle, Birds Eye senior brand manager. “Birds Eye frozen vegetables serve as a solution to one or more of these struggles.

“Frozen vegetables offer convenience by eliminating the time spent on prep before cooking — they’re ready when you are.”

She said the appeal of frozen vegetables is further enhanced — especially among picky eaters — with the offer of unique flavors, seasonings and restaurant- inspired products.

“Some of our recent innovation brings restaurant-style sides home and makes vegetables fun and delicious,” Nagle said. “Our Birds Eye Loaded Cauliflower Bites and Cauliflower Wings take a cue from on-trend appetizers, where cauliflower has seen more than 20% menu penetration growth over the past four years.”

Traditional top sellers from the Birds Eye portfolio include classic Birds Eye Steamfresh vegetables, which allow for quick and convenient prep of popular vegetables such as broccoli, sweet corn and green beans. Nagle said consumers like that the product can be easily incorporated into a wide range of recipes as well as enjoyed alone.

According to AFFI’s survey, consumers are also drawn to frozen because they get more fruits and vegetables in their diet while spending less. Of those surveyed, 86% said purchasing frozen allows them to get more fruits and vegetables in their diet, while 80% said they save money when opting for frozen over fresh.

Statistics support those responses. Frozen fruit and vegetables have experienced below-average inflation when compared to fresh. Popular products such as frozen broccoli, beans, mixed vegetables, blueberries, strawberries, cut pineapple and cut mango all cost less when purchased frozen over fresh.

Finally, surveyed consumers said purchasing frozen allows them to cut back on food waste, an issue that has been highlighted in recent years. In fact, according to USDA data, $161.1 billion worth of food goes to waste each year. Of the AFFI consumers surveyed, 68% said they never or rarely ever throw frozen fruits and vegetables away.

Looking forward

AFFI’s research into frozen fruits and vegetables found that market penetration is high, with 94% of American households buying in this segment. The research also revealed that greater freezer capacity goes hand-in-hand with increased frozen fruit and vegetable purchases. Almost one-third of the core consumers of frozen food reported that they increased their at-home freezer capacity during the pandemic.

“Still, there’s an opportunity for the entire industry to leverage the many noted advantages of frozen food to support additional growth,” Young said.

While the majority of purch

asers are drawn by ease of preparation, convenience and longer shelf life, consumers also said packaging plays an important role.

“The core shoppers of frozen produce noted that the most important packaging features for them were resealable packages, a variety of bag/serving sizes, and microwaveable options,” Young said. “

These types of packaging options help consumers as they integrate frozen fruits and vegetables into their mealtime.”

The research also revealed the many applications core consumers use frozen produce for: as sides to an entree, in smoothies, as a part of breakfast dishes and in soups and casseroles.

Going forward, industry insiders say it will be critical to help consumers purchase a wider variety of foods more frequently.

“Ultimately, there are a variety of ways that consumers can integrate frozen fruits and vegetables into their meal planning and shopping,” Young said. “Processors have a special opportunity to further promote the many meal applications for frozen produce and drive increased sales within the high market penetration.”