USDA forecasts a $40 billion drop in net farm income in 2024

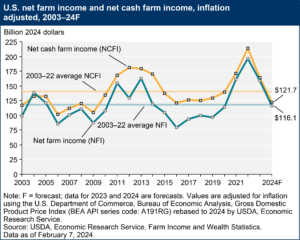

The USDA’s 2024 Farm Income Forecast predicts a $40 billion drop in net farm income in calendar year 2024, the second consecutive year of a projected dip.

The forecast, released Feb. 7, predicts a net farm income of $116.1 billion, down $39.8 billion, or 25.5%, from 2023 in nominal (not adjusted for inflation) dollars. After adjusting for inflation, 2024 net farm income is projected to decrease $43.1 million, or 27%, from 2023.

The 2023 forecast of $156 billion represented a decrease of $29.7 billion, or 16%, from 2022.

With the expected 2024 decline, net farm income in 2024 would be 1.7% below its 20-year average (2003–22) of $118.2 billion and 40.9 percent below a record high in 2022 in inflation-adjusted dollars, according to the USDA.

Net cash farm income is forecast at $121.7 billion in 2024, a decrease of $38.7 billion (24%) relative to 2023 (not adjusted for inflation). This follows a forecast decrease of $41.8 billion (20.7%) from 2022 to 2023. When adjusted for inflation, 2024 net cash farm income is forecast to decrease by $42.2 billion (25.8%) from 2023.

In 2024, net cash farm income is forecast to be 13.7% below its 2003–22 average of $141 billion and 43.2% below a record high in 2022.

Net cash farm income encompasses cash receipts from farming as well as cash farm-related income (including federal government payments) minus cash expenses. It does not include noncash items (including changes in inventories, economic depreciation and gross imputed rental income of operator dwellings) reflected in the net farm income measure.

Cash receipts from the sale of agricultural commodities are forecast to decrease by $21.2 billion (4.2%, in nominal terms) from 2023 to $485.5 billion in 2024. Total crop receipts are expected to decrease by $16.7 billion (6.3%) from 2023, led by lower receipts for corn and soybeans. Total animal/animal product receipts are expected to decrease by $4.6 billion (nearly 2%), following declines in receipts for eggs, turkeys, cattle/calves and milk.

Lower direct government payments and higher production expenses are also contributing to the projected 2024 decline, according to the USDA. Direct government payments are forecast to fall by $1.9 billion (almost 16%) from 2023 to $10.2 billion in 2024. This decrease is expected largely because of lower supplemental and ad hoc disaster assistance in 2024 relative to 2023.

Meanwhile, total production expenses, including operator dwelling expenses, are forecast to increase by $16.7 billion (3.8%) to $455.1 billion in 2024. Livestock/poultry purchases and labor expenses are expected to see the largest increases in 2024 relative to 2023.

Average net cash farm income for farm businesses is projected to decrease 27.2% from 2023 to $72,000 per farm in 2024 (in nominal terms). All nine USDA, Economic Research Service (ERS) Farm Resource Regions are expected to see average net cash farm income fall in 2024 relative to 2023, with farm businesses located in the Northern Great Plains region expected to see the largest decline, according to the USDA.

All farm businesses specializations are also forecast to see lower average net cash income in 2024. Farms specializing in wheat are expected to see the largest percentage decline, while those specializing in cotton expected to see the largest dollar decline relative to 2023.

Farm sector equity is expected to increase by 4.7% ($166.2 billion) from 2023 to $3.74 trillion in 2024 in nominal terms. Farm sector assets are forecast to increase 4.7% ($193.2 billion) to $4.28 trillion in 2024 following expected increases in the value of farm real estate assets. Farm sector debt is forecast to increase 5.2% ($27.0 billion) to $547.6 billion in 2024.

View full 2024 forecasts for farm sector income online.