HPP remains popular — if evolving — market mainstay for processors

With definitions of processed foods the subject of much recent debate, an understanding of processing methods — including a proven technique that enhances both food safety and shelf life — is essential for produce processors now and moving forward.

High-pressure processing (HPP), adopted decades ago by the meat industry as a way to combat listeria, is continuing to make produce inroads. The technique immerses fresh products in a cold-water bath and applies uniform pressure of 87,000 pounds per square inch — equivalent to six times the pressure found at the deepest part of the ocean. The process is effective at killing food-borne pathogens with the added benefit of preserving the nutritional value, appearance and taste of food — attributes that heat can adversely affect.

“As we continually become more and more aware of what ultra-processed food is and what minimally processed food is, and the more we become educated on what’s healthy for us and what’s not healthy for us, I think the demand for HPP is only going to grow, because the various offerings are going to grow,” said Rusty Stone, senior sales manager for food processing solutions company JBT Marel.

EVOLUTION OF TECHNOLOGY AND DEMAND

EVOLUTION OF TECHNOLOGY AND DEMAND

HPP’s effectiveness in guacamoles and dips is well established. An early adopter of the technology in the fruit and vegetable industry was the avocado, which boasts a high water content and solid composition that can hold its structure during the pressurization process.

The process is also being increasingly utilized in the growing beverage market, specifically in the targeted nutrition category marked by smaller, shot-sized servings of juices preferred by consumers who want the health benefits of fresh juice without the sugar content of larger portions.

“If we just hone in on apple juice, you need probably like a dozen apples just to fill one glass of apple juice,” Stone said. “If you go to that shot format, you get all your daily vitamin D, vitamin A, and all your other nutrients in one small shot without all of that added sugar content.”

According to a study by market research firm IMARC Group, the global functional drinks market increased by 10% from 2015 to 2020, with continued growth forecast for the following five years. That’s part of overall growth in the worldwide juice market, expected to grow from a $165.5 billion industry in 2025 to $229.5 billion by 2034, according to food and beverage industry consulting firm Towards FnB.

“We’re seeing an educated consumer who continues to evolve in their understanding of HPP and the benefits of HPP,” said Kevin Kennedy, JBT Marel business development manager. “Even packaging formats have changed a little bit and help continue to drive some of the demand.

“For example, there are a lot of cold-pressed juice, HPP juices, that have been traditionally in a 12- to 16-ounce bottle size. One of the big demands in the last couple of years has been for smaller shots — the same product, just in a smaller 2.5-ounce quick shot. (Consumers) are turning to shots as a way to get that quick burst of energy or fresh juice, vitamins, great flavor, etc.”

Within the smaller packaging, continued innovation includes “adding things you wouldn’t necessarily sometimes think of, like caffeine,” Kennedy said. “Maybe the consumer is used to some of the thermally processed things that have been out there without the nutrition retention. HHP (produces) much better taste than a thermally processed drink, as well as nutrition and good shelf life.”

ADAPTATION OBSTACLES

Two main obstacles remain to widespread adaptation of HPP: price and plastic.

The initial cost outlay to purchase an HPP machine can top $3 million. Companies can partially offset that by utilizing tolling centers, which provide pay-per-use levels of HPP service to companies without in-house equipment.

“Whether you’re big or whether you’re small, if you can’t invest in your own HPP system, there’s usually a place, a tolling center, that can take you,” Kennedy said. “They continue to grow and multiply, so there’s lots of ways to get into the benefits of using HPP without having to invest in your own system.”

Kennedy said some tolling centers are also beginning to offer upstream co-manufacturing services — including filling, bottling and capping — as a way to address sustainability concerns inherent in HPP. While products that use it retain more natural nutrients and flavors, they require packaging flexible enough to withstand compression, elastic enough to regain its shape and waterproof to withstand submersion.

That translates to plastic — specifically polyethylene terephthalate (PET), a clear, durable medium that is the most recycled plastic in the U.S., according to americanbeverage.org. With growing environmental concern and increasing regulations attached to that material, HPP companies are casting about for alternatives.

The industry is beginning to explore bulk solutions, such as processing temporary material through the HPP machine and then transferring that downstream to another non-plastic packaging format such as glass, Kennedy said.

“Some folks want to present a premium product, like glass, but they’re not able to put a glass in the current HPP system,” he said. “There’s pros and cons to it. There’s some additional cost relative to other things you need downstream with HPP — fillers and things like that. I think that’s going to continue to evolve, to be able to produce larger volumes and thus reduce the cost per package.

“That would (be) huge from a sustainability play, and that’s where a lot of interest initially is to get rid of plastic in that regard and go to something like glass.”

INNOVATIONS AHEAD

HPP, still a major player in the ready-to-eat segment, continues to expand into other sectors, including baby food, pharmaceuticals and premium pet food. Companies are also exploring packaging fresh products in their own juices, though HPP is not well-suited for fruits with air pockets, like strawberries or raspberries, that make them more susceptible to collapse.

“HPP doesn’t work for everything and every fresh fruit and vegetable,” Kennedy said. “Sometimes there’s some textural challenges. Some work really well, some not so well.

“Recently I’ve had some apple cider (customers) really looking hard at HPP, just because of the flavor and the pasteurization need and the extended shelf life.”

Pasteurization is one element of processing that is not just beneficial for food but necessary. Organizations such as the Cold Pressure Council work to inform customers and consumers about the processing steps in HPP.

“The word ‘processing’ doesn’t resonate in a positive way sometimes with consumers, especially nowadays,” Kennedy said. “As the education continues in that regard, they realize, ‘Oh, OK, it doesn’t do these other things. It doesn’t kill enzymes. It doesn’t kill nutrition. It doesn’t kill flavor, and it extends shelf life.’ And then they’ve got it. It’s a balancing act, for sure.”

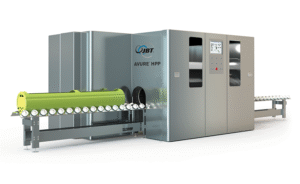

JBT Marel is well positioned to meet growing consumer demand and shifting preferences through innovations such as its AV-10 HPP Machine, which features eight million pounds of annual throughput. The company also debuted its new tabletop Fresh’n Squeeze 1800 Citrus Juicer last October at the International Fresh Produce Association Global Produce and Floral Show in Anaheim, California.

The company said businesses using Fresh’n Squeeze solutions have seen up to an 18% increase in sales driven by customer appeal and reduced floor space.

“I think of it as, you go in and make your own peanut butter. It’s the juice version of that,” Stone said. “As you continually try to avoid process items, I think you will start seeing more and more offerings like this in the marketplace, and that’s what’s really driving the success.”